Hawaii Economy: What is a Pessimistic Scenario?

Tourism has a good side and a bad side, and there are two sides to every story. UHERO, The Economic Research Organization at the University of Hawaii just presented both sides (positive and pessimistic) on what the Hawaii economy should expect in the next two years. for our Hawaii tourism-dependent economy.

Strict preventive measures appear to have halted the spread of the coronavirus in Hawaii, but they have also brought economic activity to a standstill. The combination of the stay-at home-order for local residents and the mandatory quarantine for visitors has resulted in an unprecedented plunge in employment. Although a gradual reopening of the local economy is now underway, tourism will struggle to recover for years to come, and the overall economy will suffer as a result.

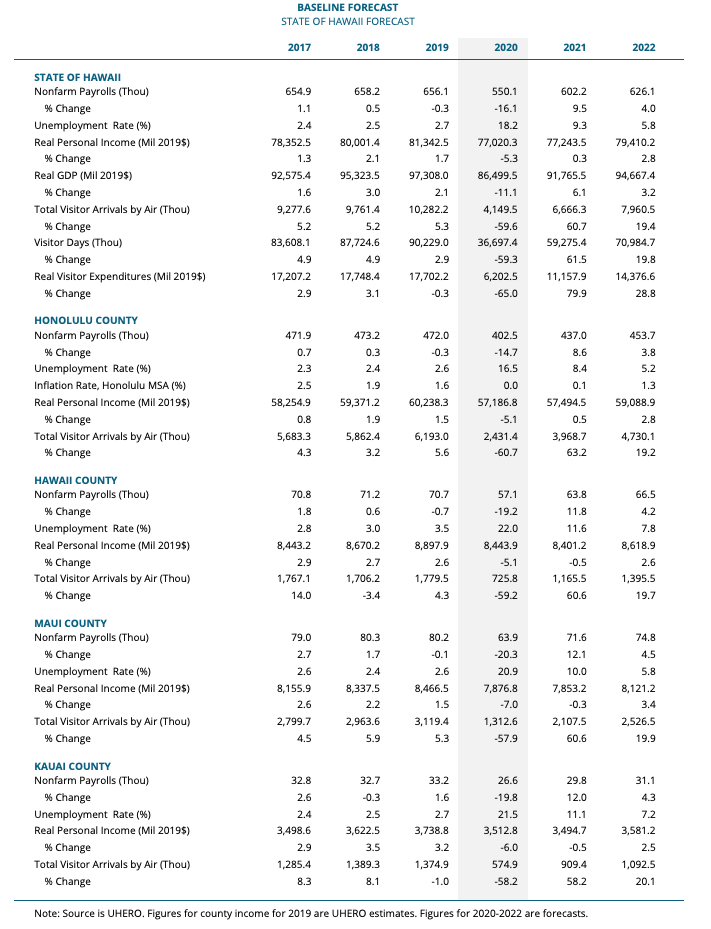

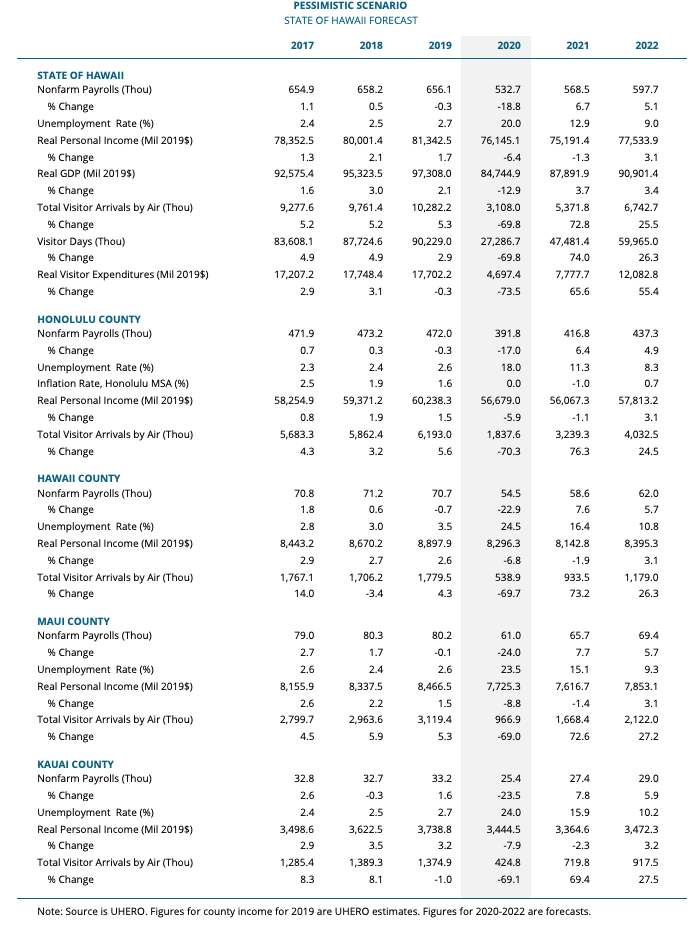

Because of the exceptional uncertainty, we provide our baseline forecast, as well as optimistic and pessimistic alternative scenarios.

Job losses in Hawaii have been decimating. We estimate that payrolls dropped by more than 220,000 by mid-April. More than half of these job losses were the direct result of the tourism halt, and the remaining due to the stay-at-home order. Layoffs were widespread, affecting every industry, but the largest losses occurred in trade and accommodation and food services. In our baseline forecast, nonfarm payrolls will post a nearly 16% decline for this year overall and will remain below their 2019 level throughout the forecast period.

An ambitious federal fiscal and monetary policy response has cushioned the impact of the coronavirus shock. Payroll support and other loan programs are helping some firms to stay afloat, and, despite delays in implementation, direct payments to individuals, enhanced unemployment, and other federal transfer payments will offset a significant portion of labor income losses. In our baseline forecast, aggregate real personal income will fall by about 5% this year, edging back up to the 2019 level by 2024.

The worldwide fallout from COVID-19 will contribute to the slow pace of Hawaii’s recovery. Shutdowns have occurred virtually everywhere, and nearly all economies are experiencing a more severe downturn than during the 2008-2009 Great Recession. Local and global supply chains remain impaired, and consumer attitudes cautious. While a rebound from second quarter lows may be sharp, the recovery to pre-crisis output levels in the US will take at least two years, with unemployment remaining elevated near 6% in 2022.

As a result of practical restart challenges and a reluctant traveling public, in our baseline forecast, we see tourists beginning to return only in late July, and the number of arrivals for the year averaging nearly 60% lower than in 2019. Further recovery thereafter will continue to be gradual, so that by 2022 there will be just over 8 million visitors to the state, compared with more than 10 million in 2019. The statewide hotel occupancy rate will average just 63% in 2022, compared with 81% in 2019.

The macroeconomic toll of the crisis will be somewhat larger on the Neighbor Islands than on Oahu because of their greater reliance on the visitor industry. In our baseline forecast, unemployment rates will average more than 20% this year in each of the Neighbor Island counties. Absent substantial additional federal funding, Hawaii’s State and local governments will face both near-term shortfalls and medium-term financing costs, adding uncertainty to the ability of state and local governments to provide needed services.

In our pessimistic scenario, we assume no significant tourism reopening until autumn. Visitor arrivals would post an annual decline of 70% this year and remain significantly below the 2019 peak through the end of the forecast horizon. For this year as a whole, real income would decline more than 6%, and non-farm payrolls would be down nearly 20%. The nonfarm job count would still be 58,000 jobs below its pre-crisis level in 2022, and the statewide unemployment rate would remain at 9%.

In our optimistic scenario, good control of the virus nationally and abroad within the next two months would allow a moderate return of visitors by late summer, and, by this fall, businesses catering primarily to the local market would recover about 80-85% of the recent decline. Two-thirds of job losses would be recovered by next year. Even so, persisting social-distancing measures would continue to impose significant ongoing costs for tourism. Even with a relatively steep path of initial gains, visitor numbers would fall short 2019 levels for the next five years

Hawaii’s heavy reliance on tourism means that the local economy will lag behind the national pace of recovery progress. But how recovery proceeds will depend crucially on government policy responses. More direct federal support to states and counties is desperately needed, and hopefully some will be forthcoming. Regardless, the State needs to spend its available resources now to preserve companies, worker skills, and consumer and business finances. This will ensure that Hawaii can make as rapid and complete a recovery as possible